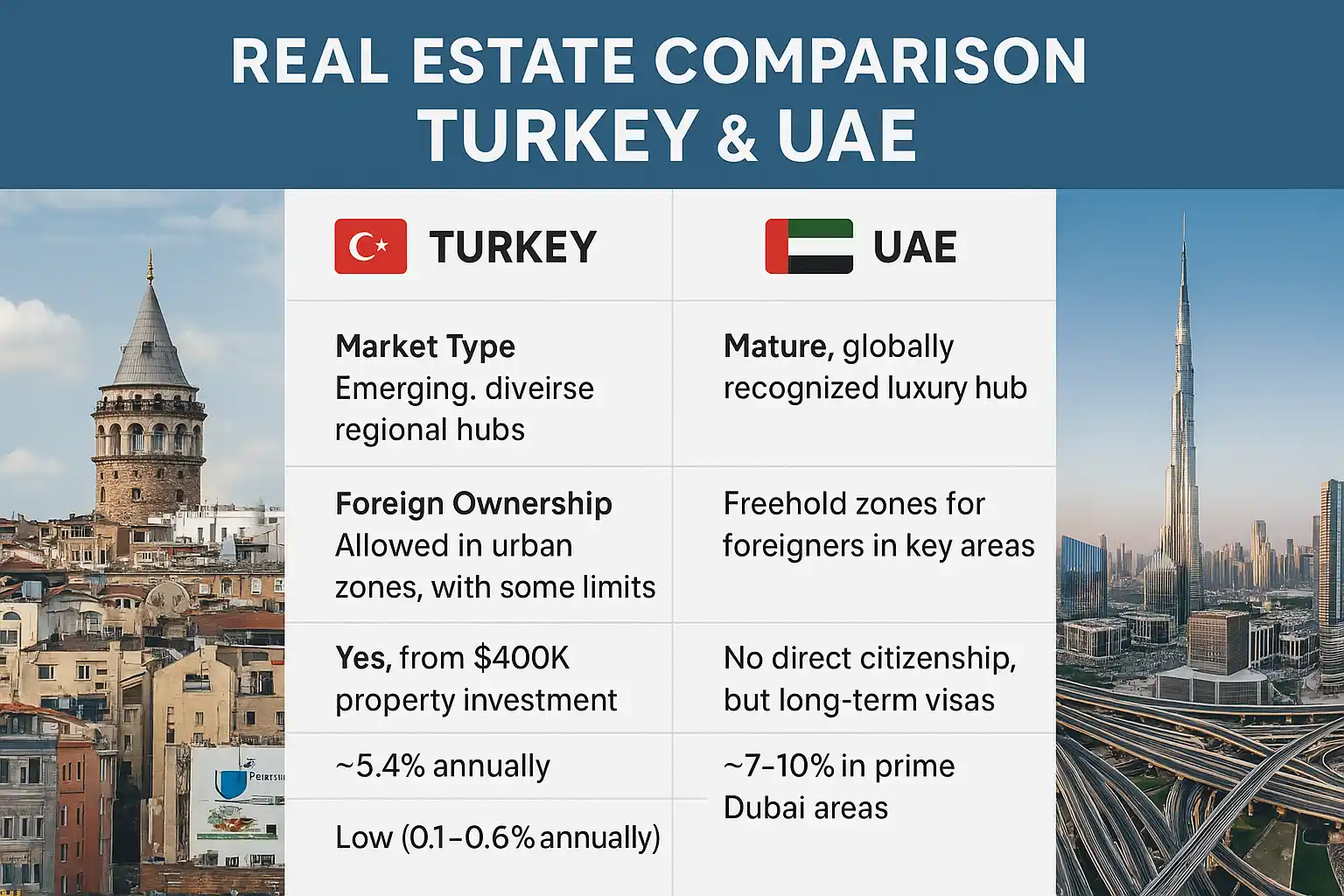

از سال ۲۰۲۵، سرمایهگذاران جهانی به طور فزایندهای در حال سنجش مزایای ... سرمایهگذاری در املاک و مستغلات در امارات متحده عربی - به ویژه دبی - در برابر فرصتها در ترکیهاگرچه هر دو بازار جذاب هستند، اما از نظر ... تفاوتهای قابل توجهی دارند. بازگشت سرمایه (ROI)، چارچوبهای قانونی، مالیات و ثبات بلندمدت.

بازده سرمایهگذاری و اجاره

| متریک | دبی (امارات متحده عربی) | ترکیه |

|---|---|---|

| بازگشت سرمایه (میانگین) | ۶–۱۰۱TP3T در حوزههای انتخابیه برتر | ۳–۱۰۱TP3T، معمولاً ۷–۱۰۱TP3T در مناطق پر تقاضا |

| درآمد اجاره | معاف از مالیات، با پشتوانه تقاضای قوی | تحت تأثیر کاهش ارزش لیر و هزینههای بالا |

| رشد سرمایه | افزایش پایدار و بلندمدت | مستعد جهشهای شدید، اما ناپایدار |

دبی به طور مداوم در میان شهرهای برتر جهان از نظر بازده اجاره، به ویژه در نقاط مهم مانند دبی مارینا، جمیرا ویلج سیرکل (JVC) و مرکز شهر دبی قرار دارد. بدون مالیات بر درآمد یا سود سرمایه، سرمایهگذاران از مزایای آن بهرهمند میشوند. اظهارنامه اجاره تمیز و معاف از مالیات و یک واحد پول پایدار درهم امارات.

ترکیه، در حالی که بازده کلی بالایی ارائه میدهد - تا 10% در برخی شهرها - اغلب این بازدهها به دلیل ... کاهش مییابد. کاهش ارزش پول, تورم، و هزینههای سربار تعمیر و نگهداریبا این حال، قیمتهای ورودی پایینتر آن، آن را برای کسانی که به دنبال سرمایهگذاریهای مبتنی بر ارزش یا مرتبط با شهروندی.

چارچوب قانونی و مشوقهای سرمایهگذاری

دبی (امارات متحده عربی):

- مالکیت دائمی برای خارجیها در مناطق تعیینشده

- شرایط ویزای طلایی برای املاک بالای ۲ میلیون درهم.

- بدون مالیات بر ارث، مالیات بر سود سرمایه یا مالیات بر درآمد.

- سیستم حقوقی شفاف و قانونمند مطابق با استانداردهای بینالمللی.

ترکیه:

- حقوق مالکیت کامل برای خارجیها در اکثر مناطق.

- خرید ملک از $400,000+ واجد شرایط برای شهروندی.

- قوانین مناسب برای سرمایهگذاران با کاهش بوروکراسی.

- اخذ اقامت آسانتر است - اما مسیر شهروندی شامل رویههای بوروکراتیک و سیاستهای در حال تحول است.

چشمانداز بازار و ریسکهای سرمایهگذاری

دبی:

- اعتماد بالای سرمایهگذاران جهانی ناشی از ثبات سیاسی، مزایای مالیاتی و گسترش زیرساختها.

- ارز وابسته به دلار آمریکا، ریسکهای فارکس را کاهش میدهد.

- گسترش پروژههای لوکس، مهماننوازی و بخشهای چندمنظوره، دبی را به مکانی ایدهآل برای حفظ سرمایه بلندمدت.

- رشد پایدار قیمتها در چهار سال گذشته بدون اصلاح ممکن است باعث کاهش شدید بازار شود.

- مورد انتظار عرضه بالا تعداد املاک موجود در بازار برای سال 2026 به بعد احتمالاً بر سطح قیمت تأثیر خواهد گذاشت

ترکیه:

- افزایش قیمتها (30%+ سالانه در اوایل سال 2025) سرمایهگذاران کوتاهمدت را جذب میکند.

- جذابیت قوی برای کسانی که به دنبال سبک زندگی در مجاورت اتحادیه اروپا، درآمد مبتنی بر گردشگری و شهروندی هستند.

- خطرات کلیدی: نوسانات لیر ترکیه, اصلاحات اقتصادی، و تغییرات نظارتی.

دسترسی به قیمت: داستان دو بودجه

| بازار | بودجه تقریبی برای آپارتمان دو خوابه |

|---|---|

| ترکیه | $150,000–$250,000 (استانبول، آنتالیا، آلانیا) |

| دبی | ۶۰۰ هزار تا ۱ میلیون درهم (~۱TP4T160,000–$270,000)، در مناطق درجه یک بیشتر |

ترکیه به سرمایهگذاران اجازه میدهد چندین واحد را بدست آورید با همان سرمایهای که برای یک ملک میانرده در دبی لازم است - و آن را برای تنوعبخشی به سبد سرمایهگذاری یا اخذ شهروندی از طریق سرمایهگذاری جذاب میکند.

مشخصات سرمایهگذاران: چه کسی باید کجا سرمایهگذاری کند؟

| جنبه | دبی (امارات متحده عربی) | ترکیه |

|---|---|---|

| ایدهآل برای | بازگشت سرمایه بلندمدت، حفظ ثروت، درآمد اجاره معاف از مالیات | جویندگان شهروندی، سرمایهگذاران ارزشی، خریداران سبک زندگی |

| خطرات اصلی | هزینههای ورود، نوسانات جهانی | کاهش ارزش پول، عدم قطعیت اقتصادی |

| گزینههای ویزا/شهروندی | ویزای طلایی، بدون نیاز به شهروندی | شهروندی مستقیم با سرمایهگذاری ۱TP4T400K+ |

| روند بازار | قدردانی تدریجی، ورود بینالمللی | سودهای کوتاهمدت، جهشهای ناشی از تورم |

بینش املاک و مستغلات (2025)

در مشاور املاکما با تخصص محلی و خدمات جامع، سرمایهگذاران جهانی را در بازارهای املاک دبی و ترکیه راهنمایی میکنیم.

- انتخاب کنید دبی برای:

- پایداری, امنیت ارزی، و درآمد غیرفعال معاف از مالیات

- بازده بالای اجاره در مناطق تحت نظارت و با تقاضای بالا

- اقامت سرمایه گذار از طریق ویزای طلایی (۲ میلیون درهم به بالا)

- فرآیندهای شفاف و سهولت انجام کسب و کار

- انتخاب کنید ترکیه برای:

- نقاط ورود مقرون به صرفه و مسیر سریعتر برای شهروندی

- پتانسیل بالای گردشگری، به ویژه در استانبول و مناطق ساحلی

- بازگشت سرمایه کوتاه مدت بالقوه - اما با ارزیابی دقیق ریسک به دلیل نوسانات لیر و عوامل اقتصادی

بگذارید Realty Homist در تصمیمگیری به شما کمک کند

چه یک سرمایهگذار با دارایی خالص بالا باشید که به دنبال افزایش سرمایه بلندمدت است و چه یک خریدار بینالمللی که به دنبال اخذ سریع شهروندی است، مشاور املاک ارائه دهنده راهکارهای شخصی سازی شده در سراسر دبی و ترکیهمشاوران چندزبانه ما به شما در ارزیابی موارد زیر کمک میکنند:

- بهترین مناطق برای سرمایه گذاری

- قوانین حقوقی و مالکیت

- مسیرهای ویزا/شهروندی

- پیامدهای مالیاتی و برنامهریزی مالی

تماس با املاک هومیست امروز از طریق +971 55 726 7250 برای تعیین وقت مشاوره رایگان و متناسب با نیاز خود با مشاوران متخصص املاک ما تماس بگیرید.

با هم، ثروت میسازیم