The Dubai real estate market continues to thrive in Q3 2024, reflecting dynamic trends and robust investment opportunities. Realty Homist is pleased to share insights from the latest quarterly data, which underscores Dubai’s growing appeal among global investors and residents alike. Here’s a breakdown of the key market highlights and trends that defined Q3 2024.

1. Transaction Volume and Value

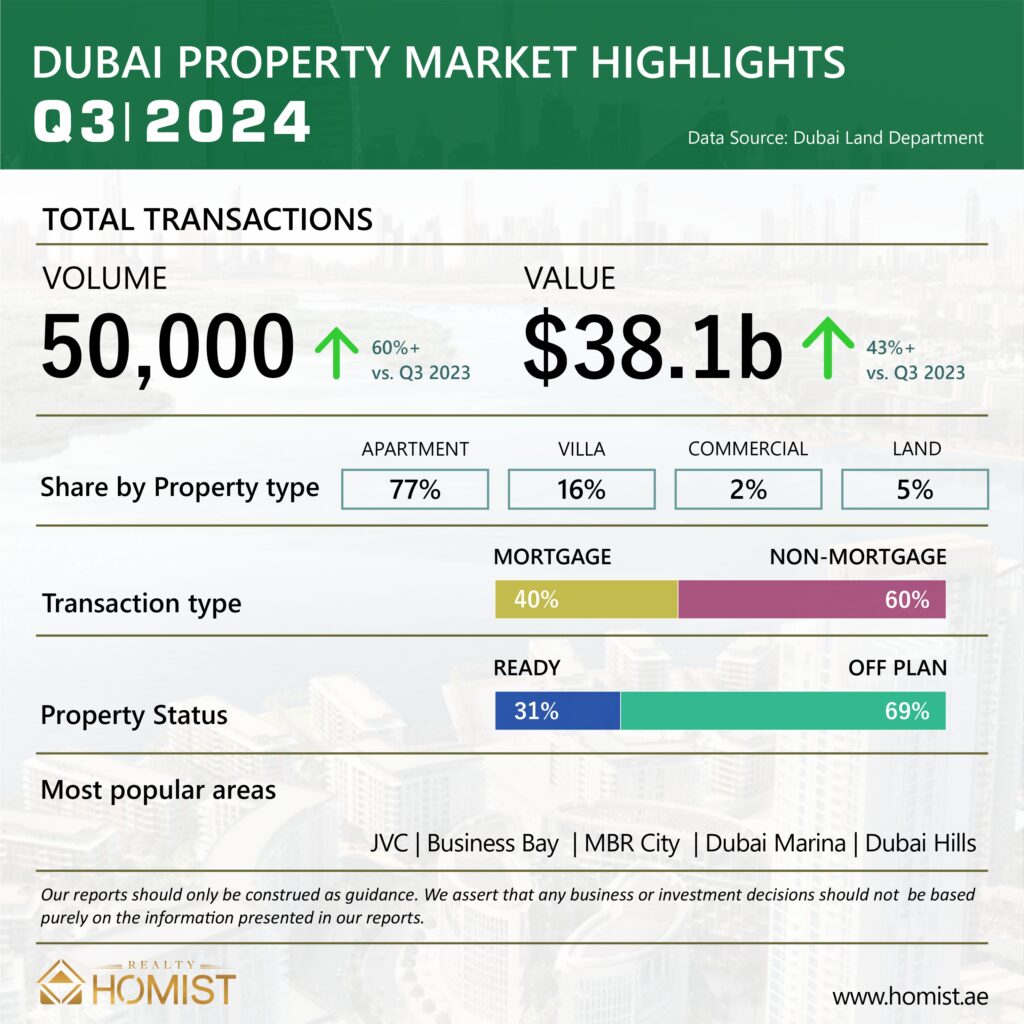

In Q3 2024, the Dubai property market achieved a milestone with a transaction volume of 50,000 units, translating to a total value of $38.1 billion. This represents a 13.6% increase in volume and a 9% growth in value compared to Q2 2024. These figures underscore the steady expansion of Dubai’s real estate sector, which continues to attract both local and international interest.

2. Mortgage vs. Non-Mortgage Transactions

Financing dynamics remain stable, with 40% of transactions financed through mortgages, while the remaining 60% were cash purchases. This balance signals sustained interest from cash buyers, likely due to Dubai’s appeal as a secure investment destination and the confidence of high-net-worth individuals in the market’s long-term potential.

3. Off-Plan vs. Ready Properties

Off-plan properties accounted for 69% of transactions, while ready properties represented 31%, highlighting a growing appetite for under-construction units. With several high-profile developments underway, investors are increasingly drawn to new projects that offer flexible payment plans, future-ready designs, and potentially higher returns upon completion.

4. Top-Performing Areas

The most sought-after areas in Q3 2024 were:

- Jumeirah Village Circle (JVC) – A consistent favorite for off-plan buyers, supported by a high number of new units catering to both investors and residents.

- Mohammed Bin Rashid (MBR) City – Known for luxury developments, MBR City saw substantial interest due to ongoing high-end projects and competitive ROI.

- Dubai Hills Estate – Continues to be popular for both residential and investment purposes, drawing families and long-term residents to its planned communities and abundant amenities.

- Dubai Marina – This iconic waterfront location remains highly desirable, particularly for buyers seeking ready-to-move-in luxury apartments.

5. Comparative Analysis with Q2 2024

Compared to Q2, Q3 2024 saw a notable uptick in off-plan sales, rising from 65% in Q2 to 69% in Q3, fueled by continuous developer launches and appealing off-plan offers. Additionally, JVC and MBR City remained dominant, with minor price adjustments in response to demand patterns. The Q3 results highlight sustained investor confidence, further bolstered by Dubai’s regulatory stability and economic growth.

6. Future Outlook

As we move towards the close of 2024, the outlook for Dubai’s property market remains optimistic. The steady pipeline of new projects and ongoing infrastructure investments are expected to support continued growth. Potential challenges, such as balancing demand and supply in the off-plan segment, will be closely monitored. However, with over 52,000 units expected to be completed by year-end, the market appears well-positioned to meet investor demand without an immediate risk of oversupply.

REALTY HOMIST – Your Trusted Partner in Dubai Real Estate

With deep expertise and comprehensive services, Realty Homist stands as a leader in Dubai’s real estate market. We are dedicated to guiding investors through every step, from selecting high-potential properties to navigating financing options. Reach out to our team for insights and personalized advice on maximizing your investment in Dubai’s thriving property sector.

📧 contact@homist.ae

📞 +971 55 726 7250

🌐 www.homist.ae

Disclaimer: This report is for informational purposes only and should not be considered as financial or investment advice.